How to control oneself from compulsive buying?

Controlling oneself from compulsive buying can be challenging, but with some strategies and self-awareness, it is possible. Here are some steps to help you regain control:

Recognize the Problem: Acknowledge and accept that you have a compulsive buying behavior that is causing distress or financial harm. Understanding that it is a problem is the first step towards making positive changes.

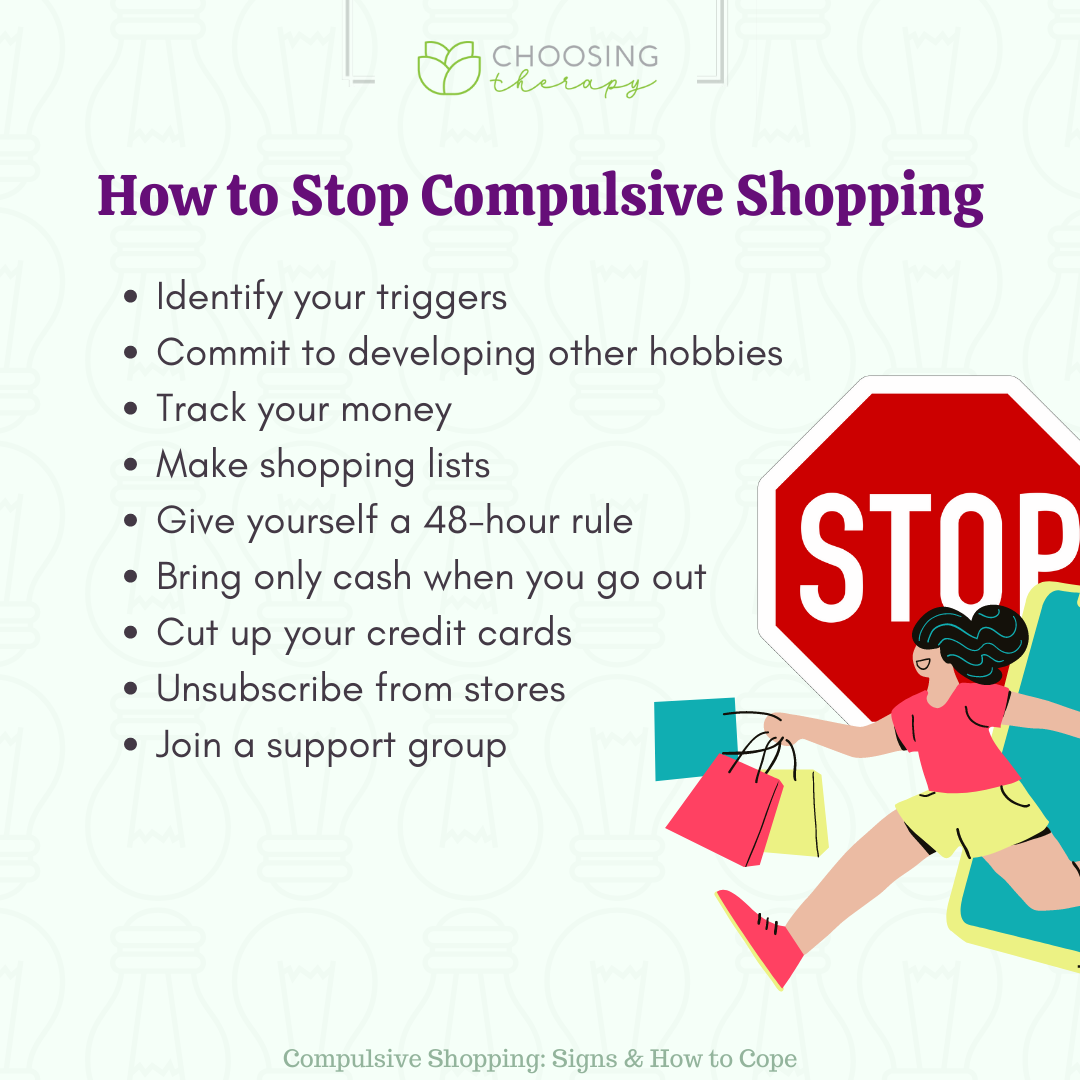

Identify Triggers: Pay attention to the situations, emotions, or triggers that lead to your impulsive buying behavior. It could be stress, boredom, loneliness, or the desire for instant gratification. By identifying these triggers, you can better prepare yourself to resist the urge to make impulsive purchases.

Create a Budget and Stick to It: Establish a realistic budget that aligns with your financial goals and priorities. Plan your expenses in advance, including necessary purchases and savings goals. By having a budget and tracking your spending, you can make more intentional and conscious decisions about where your money goes.

Practice Delayed Gratification: When you feel the urge to make an impulsive purchase, force yourself to wait. Give yourself a cooling-off period, such as 24 hours or a week, before making the purchase. During this time, evaluate whether the item is truly necessary or if it is just a fleeting desire. Often, the initial excitement fades, and you may realize that you don't really need or want the item.

Find Alternative Coping Mechanisms: Explore healthy ways to cope with emotions or stress that don't involve shopping. Engage in activities like exercise, meditation, spending time with loved ones, pursuing hobbies, or practicing self-care. These activities can provide fulfillment and help you manage emotions without resorting to compulsive buying.

Unsubscribe and Limit Temptations: Unsubscribe from marketing emails, catalogs, and unsubscribe from online shopping apps or websites that trigger impulsive buying. Avoid situations where you're tempted to make impulsive purchases, such as browsing malls or online stores without a specific purpose.

Seek Support: Consider reaching out to a trusted friend, family member, or therapist who can offer support and accountability. They can help you stay motivated, provide perspective, and offer alternative strategies for managing your emotions or impulses.

Reflect on Your Values: Take time to reflect on your values and long-term financial goals. Remind yourself of what truly matters to you and how compulsive buying aligns or conflicts with those values. This can provide a sense of purpose and motivation to resist impulsive purchases.

Remember, breaking the cycle of compulsive buying takes time and effort. Be patient with yourself and celebrate small victories along the way. If you find that your compulsive buying behavior is significantly impacting your life and you're unable to control it on your own, consider seeking professional help from a therapist or counselor who specializes in financial issues or compulsive behaviors.

Comments

Post a Comment