How to open your IRA in 2023?

To open your own Individual Retirement Account (IRA) and understand the contribution limits for 2023, follow these steps:

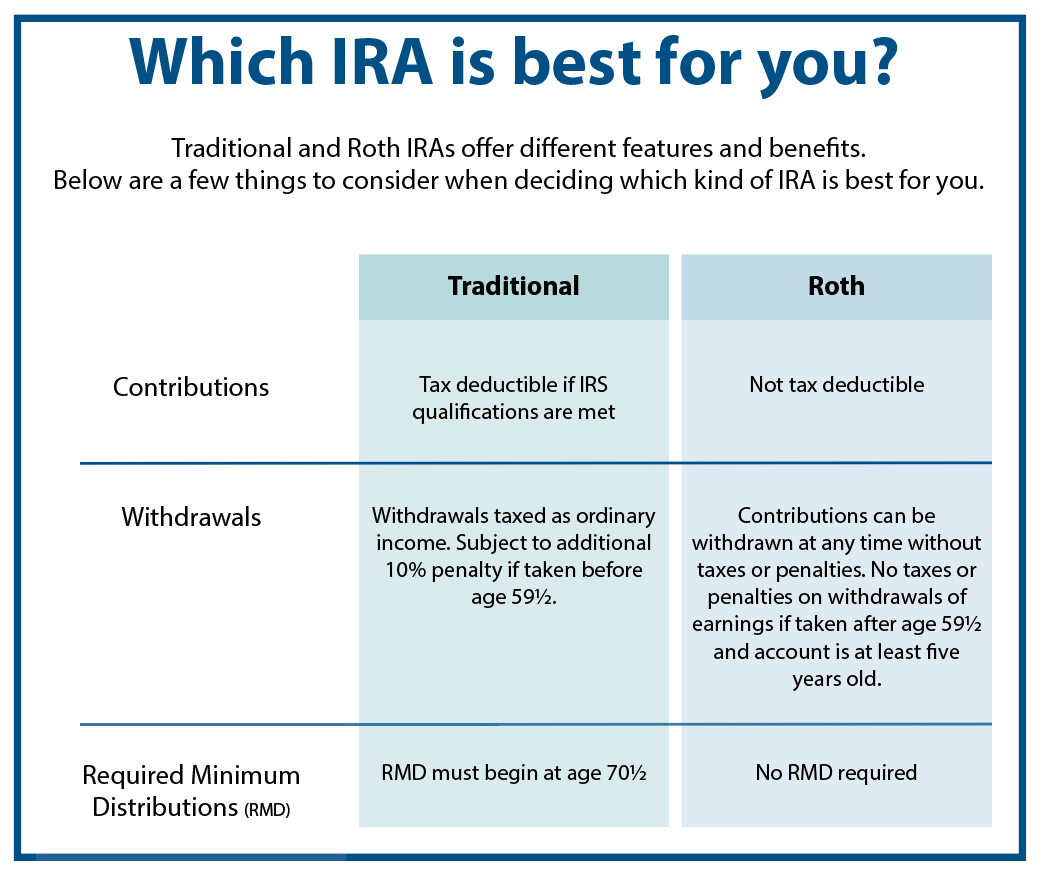

Choose the Type of IRA: Decide between a Traditional IRA or a Roth IRA. Traditional IRAs offer potential tax deductions on contributions, while Roth IRAs provide tax-free withdrawals in retirement. Consider your current and future tax situation when making this decision.

Select a Financial Institution: Research and choose a reputable financial institution that offers IRA accounts. Options include banks, credit unions, brokerage firms, and online investment platforms. Consider factors such as fees, investment options, customer service, and user-friendly platforms.

Gather Required Documents: You will need certain documents to open an IRA, including your Social Security number, date of birth, contact information, and employment details. Prepare these documents in advance to streamline the account opening process.

Complete the Application: Contact the chosen financial institution or visit their website to complete the IRA application. Provide the required information accurately and follow the instructions provided. You may need to sign and submit the application electronically or by mail.

Fund Your IRA: Decide how much you want to contribute to your IRA for the year. The contribution limits for IRAs are set by the Internal Revenue Service (IRS) and can change annually. For 2023, the contribution limit for both Traditional and Roth IRAs is $6,000 if you're under 50 years old. If you're 50 years old or older, you can make an additional catch-up contribution of $1,000, bringing the total limit to $7,000.

Choose Investments: Once your IRA is funded, you'll need to decide how to invest the money within the account. Most financial institutions offer a range of investment options, including mutual funds, exchange-traded funds (ETFs), stocks, bonds, and more. Consider your risk tolerance, time horizon, and financial goals when selecting investments.

Set Up Automatic Contributions: Consider setting up automatic contributions to your IRA. This allows you to contribute regularly without having to remember to make manual deposits. Automating your contributions can help you stay consistent and build your retirement savings over time.

Monitor and Adjust: Regularly review your IRA and the performance of your investments. Make adjustments as needed based on your goals, risk tolerance, and market conditions. Consider consulting with a financial advisor if you need guidance or reassurance about your investment decisions.

It's important to note that IRA rules and regulations can be complex, and tax implications may apply. It's recommended to consult with a tax professional or financial advisor who can provide personalized advice based on your specific circumstances.

Additionally, contribution limits can change, so it's advisable to check the IRS website or consult with a financial professional to ensure you have the most up-to-date information regarding IRA contribution limits for the year you plan to contribute.

Comments

Post a Comment