What is APY?

APY stands for Annual Percentage Yield, which is a measure of the annualized rate of return on an investment or savings account, including compound interest. It takes into account the compounding effect and provides a more accurate representation of the overall return.

The APY offered by financial institutions can vary, and it's important to note that the rates can change over time. As an AI language model with a knowledge cutoff in September 2021, I don't have access to real-time information on the highest APYs in 2023. Therefore, it's recommended to check with reputable financial institutions, banks, or credit unions to get up-to-date information on the highest APYs available.

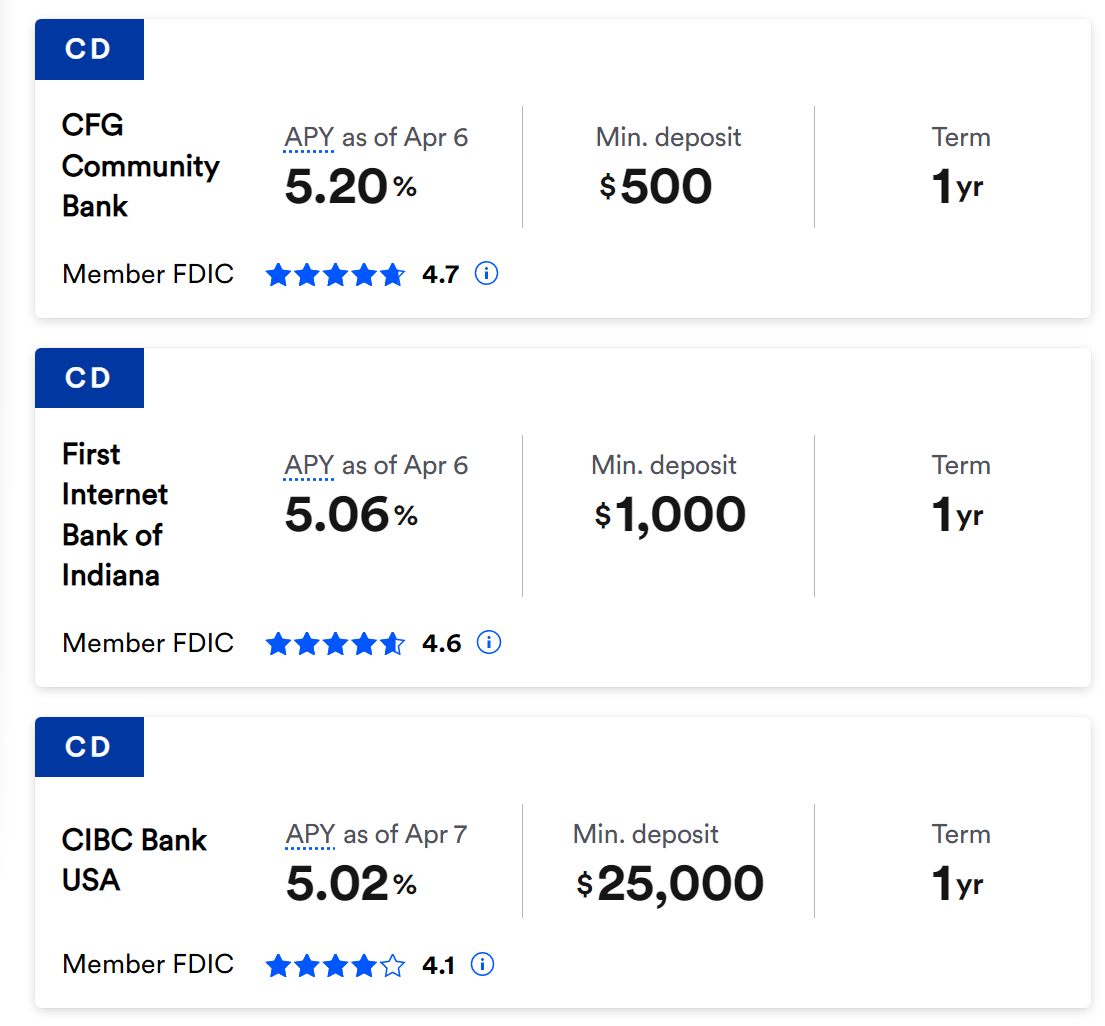

When looking for high APYs, consider factors such as the type of account (savings, money market, or certificate of deposit), any minimum deposit requirements, any applicable fees, and the overall reputation and stability of the financial institution.

It's also worth noting that higher APYs often come with certain terms and conditions, such as maintaining a minimum balance or meeting specific requirements, so be sure to review the terms carefully before making a decision.

To stay informed about the current APY offerings, you can check financial websites, consult with local banks or credit unions, or use online comparison tools that provide information on interest rates and APYs across different institutions.

Comments

Post a Comment