What is social security retirement age requirement?

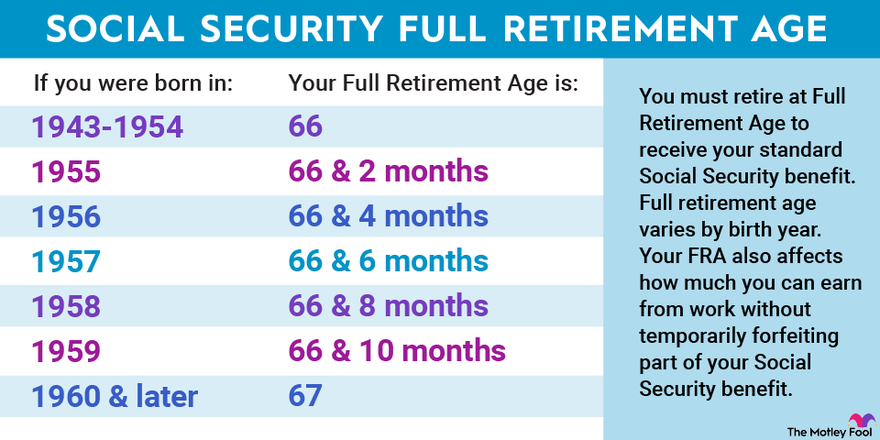

The full retirement age (FRA) for Social Security benefits is the age at which you are eligible to receive full unreduced retirement benefits. The FRA depends on the year you were born, and it has been gradually increasing as a result of changes in the law. Here are the current FRA requirements:

If you were born in 1937 or earlier, your full retirement age is 65.

If you were born between 1938 and 1959, the FRA gradually increases by two months for each birth year. For example, if you were born in 1955, your full retirement age is 66 and two months.

If you were born in 1960 or later, the FRA is 67.

It's important to note that you can choose to claim Social Security retirement benefits as early as age 62, but your monthly benefit amount will be reduced based on the number of months you claim early. On the other hand, if you delay claiming benefits beyond your FRA, your monthly benefit amount will increase, resulting in higher payments.

Here are a few key points to consider:

Early Retirement: You can choose to begin receiving reduced Social Security retirement benefits as early as age 62. However, if you start benefits before your full retirement age, your monthly benefit amount will be permanently reduced.

Delayed Retirement: If you delay claiming Social Security retirement benefits beyond your full retirement age, your monthly benefit amount will increase by a certain percentage. This increase is called a "delayed retirement credit" and can continue up until age 70.

Spousal Benefits: If you are married, you may be eligible to receive spousal benefits based on your spouse's work history. Spousal benefits can be claimed as early as age 62, but they may be reduced if claimed before your own full retirement age.

Medicare Enrollment: It's important to note that your eligibility for Medicare benefits starts at age 65. You can sign up for Medicare even if you choose to delay claiming Social Security retirement benefits.

It's advisable to consult the official Social Security Administration website or speak with a Social Security representative to get specific and up-to-date information regarding your retirement age and benefits. They can provide personalized guidance and help you understand your options and the potential impact of claiming benefits at different ages.

Comments

Post a Comment